| The Delegate Howard P. Rawlings Guaranteed Access (GA) Grant is a need-based grant that provides financial assistance to eligible applicants enrolled at Maryland postsecondary institutions for educational expenses. The maximum award amount for the Guaranteed Access Grant will be determined once the State of Maryland budget for fiscal year 2027 is determined.

|

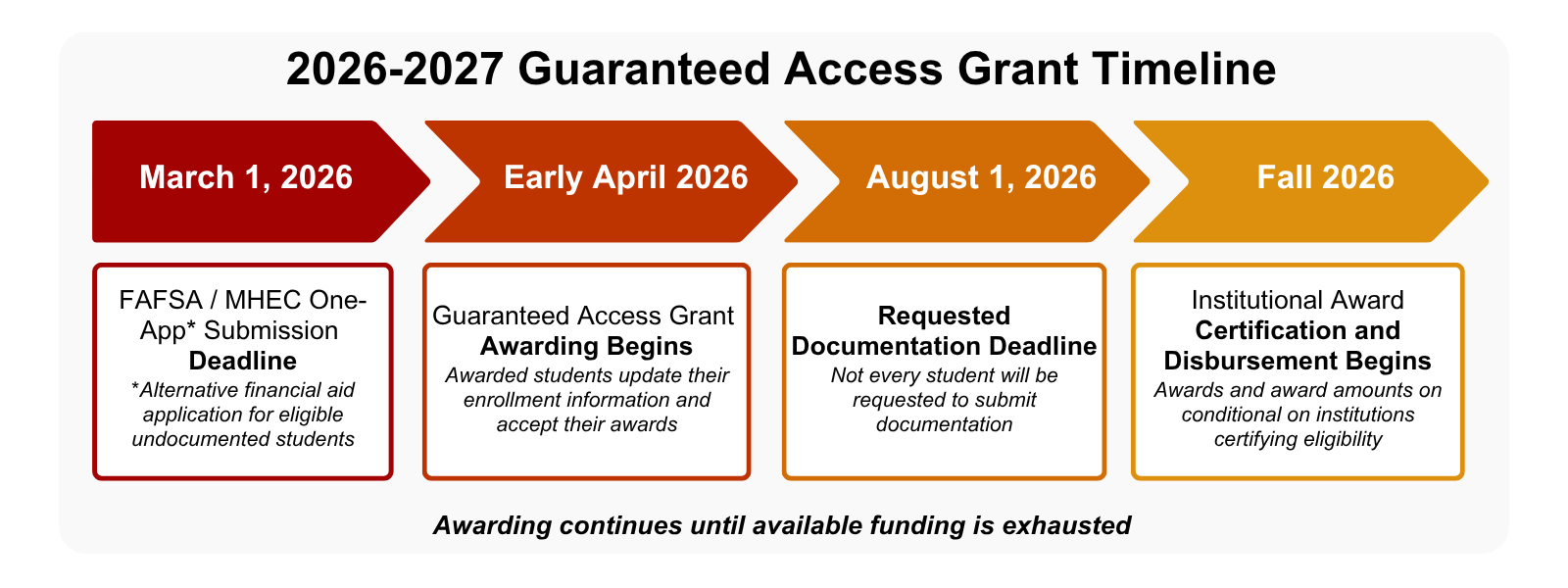

Application Timeline

- Consideration Deadline: Students must submit their 2026-27 FAFSA or MHEC One-App by March 1, 2026 in order to be considered for the Guaranteed Access Grant.

- Award Date: Awarding is anticipated to begin the first week of April 2026, and will continue until all funds have been exhausted.

- Documentation Deadline: The deadline for all documentation is August 1, 2026. Not every student will be required to submit additional documentation.

- Note: Awarding will begin before the documentation deadline. Students assigned documentation should upload their documentation as soon as possible.

Eligibility Requirements:

Individuals applying for the Guaranteed Access Grant for the first time must:

- Be eligible for in-state tuition in Maryland;

- By March 1, 2026: file the 2026-2027 Free Application for Federal Student Aid (FAFSA) or State financial aid application for undocumented students (formerly MSFAA) through the new MHEC One-App;

- The FAFSA is open to U.S. Citizens and Eligible Non-Citizens

- The State financial aid application through the MHEC One-App is for residents of Maryland who are eligible for in-state tuition but NOT eligible to file the FAFSA (undocumented students)

- Students must have a Maryland university or college listed on their FAFSA or MHEC One-App by March 1, 2026

- Submit any required documentation (see Documentation below) by August 1, 2026;

- Meet the initial income requirements for the 2026-2027 academic year (see Initial Applicants – Income Requirements below);

- Be accepted for admission and plans to enroll in a regular undergraduate program at an eligible two-year or four-year Maryland institution as a full-time (12 credits/semester) degree-seeking undergraduate student;

- Have completed high school or obtained a GED with a passing score of 145 per module;

- Must begin college within 6 years of completing high school or obtaining a GED;

- Be under the age of 26 at time of first receiving the GA;

- For the 2026-2027 year, must be born after July 1, 2000

- Cannot have previously received an Educational Assistance Grant;

- Cannot have previously received a bachelor's degree prior to the start of the 2026-2027 academic year.

MDCAPS will automatically consider students qualified for the Guaranteed Access Grant if they meet the basic eligibility requirements.

2026-2027 GA Initial Applicants- Income Requirements

Initial recipients of the GA must have an annual total family income that is at or below 130% of the federal poverty guidelines for the prior-prior tax year. For the 2026-2027 academic year, this would be the 2024 tax year poverty guidelines.

Household Size | 130% of 2024 Poverty Level |

1 | $19,578 |

2 | $26,572 |

3 | $33,566 |

4 | $40,560 |

5 | $47,554 |

6 | $54,548 |

7 | $61,542 |

8 | $68,536 |

For each additional family member beyond eight, add | $6,994 |

Selection Process & Requirements:

For students to be considered for the 2026-27 Guaranteed Access Grant, they must submit a 2026-27 FAFSA or MHEC One-App by March 1, 2026. There is no specific application for the Guaranteed Access Grant.

Students may be asked to submit certain documentation if they meet one or more of the following circumstances:

- Have received a GED in lieu of a high school diploma

- Have been deemed as “Independent” for financial aid purposes on either the FAFSA or MHEC One-App

- Have filed an MHEC One-App as a dependent student

- Have filed an MHEC One-App, are male, and 18 years or older

- Have filed a FAFSA, and do not have family size listed

- Have been randomly selected for financial verification by the Maryland Higher Education Commission

Not all students will be requested to submit additional documentation. For students that have been asked to submit documentation, that documentation is required for continued consideration for the Guaranteed Access Grant.

Students who have been asked to submit additional documentation must submit it online through their MDCAPS account (

https://mdcaps.mhec.state.md.us) by

August 1, 2026, unless listed otherwise below.

GED Recipients

| - Copy of GED exam transcript

|

Independent Students

| Which documentation will be request is determined based on answers provided in the FAFSA or MHEC One-App - multiple documents will be requested

- Proof of Independent Student Status - Legal Guardianship

- Proof of Independent Student Status - Orphan or Ward of the Court

- Proof of Independent Student Status - Unaccompanied or Homeless Youth

- Proof of Independent Student Status - Foster Care

- Proof of Independent Student Status - Student has Dependents

- Proof of Independent Student Status - Armed Services Veteran

- Proof of Independent Student Status - Active Duty in Armed Services

|

Dependent MHEC One-App Filer

| - MHEC One-App Parent Signature Page

|

Male MHEC One-App Filer Who is 18 Years or Older

| - Proof of registration for the Selective Service (if not previously provided to the Maryland Higher Education Commission)

- Award cannot be paid out until proof of registration received. Deadline to submit is June 1, 2027

|

FAFSA Filer Missing Family Size

| - Family Size Verification Form

|

Students Selected for Financial Verification

| Which documentation will be requested is determined based on answers provided in the FAFSA or MHEC One-App- Dependent or Independent Student Verification Form

- 2024 IRS Tax Transcripts or Signed 1040 Forms for Student/Student’s Spouse

- 2024 IRS Tax Transcripts or Signed 1040 Forms for Student’s Parent(s)

- 2024 W-2s, 1099s, or Schedule Cs for Student/Student’s Spouse

- 2024 W-2s, 1099s, or Schedule Cs for Student’s Parent(s)

- 2024 Maryland State Tax Return for Student/Student’s Spouse

- 2024 Maryland State Tax Return for Student’s Parent(s)

- 2024 Verification of Tax Non-Filing Form or IRS Non-Filing Letter

- Additional documentation as requested by MHEC

|

Documentation:

Below are further details regarding specific documentation requirements and what is accepted as satisfactory for those documents.

- Proof of Independent Student Status - Legal Guardianship

- Accepted documentation: Court order, signed by a judge, stating student is placed in a legal guardianship

- Proof of Independent Student Status - Orphan or Ward of the Court

- Accepted documentation if student is an orphan at age of 13 or older: Death certificate of parent(s); birth certificate of student; if student has been adopted, adoption papers

- Accepted documentation if student is a ward of the court: Court order, signed by a judge, stating student is considered a ward of the court

- Proof of Independent Student Status - Unaccompanied or Homeless Youth

- Accepted documentation: A McKinney-Vento Homeless Assistance Act letter from a local educational agency homeless liaison OR documentation from the director/designee of an emergency or transitional shelter, street outreach program, homeless youth drop-in center or other program serving individuals experiencing homelessness OR documentation from the director/designee of a Federal TRIO program or GEAR UP grant OR documentation from an institution’s financial aid administrator determining the student is an unaccompanied homeless youth, or unaccompanied, at risk of homelessness, and self-supporting; must show status as of July 1, 2025 or later

- Proof of Independent Student Status - Foster Care

- Accepted documentation: Court order or other state documentation that student received federal or state support in foster care at age 13 or older OR documentation from public or private foster care agency

- Proof of Independent Student Status - Armed Services Veteran

- Accepted Documentation: Copy of DD214 (Certificate of Release or Discharge from Active Duty)

- Proof of Independent Student Status - Active Duty in Armed Services

- Accepted Documentation: Current military orders OR most recent Leave and Earnings Statement OR letter from student’s commanding officer

- Proof of Independent Student Status - Student has Dependents

- Accepted Documentation: Birth certificate of child dependents OR proof of custody or other documentation showing the relationship of other dependents; proof of income in the form of W-2s, pay stubs, or most recent filed taxes (ie IRS tax transcript or signed 1040) OR proof of benefits such as SNAP, WIC, or TANF

- MHEC One-App Parent Signature Page

- Accessible for download inside a student’s MDCAPS account by selecting “Check Application Status”

- Proof of registration for the Selective Service

- Students can learn more about eligibility, registration, and verification via the Selective Service System: https://www.sss.gov/

- Family Size Verification Form

- Accessible for download inside a student’s MDCAPS account by selecting “Check Application Status”

- Dependent or Independent Student Verification Form

- Accessible for download inside a student’s MDCAPS account by selecting “Check Application Status”

- 2024 Verification of Tax Non-Filing Form or IRS Non-Filing Letter

- If requested, student may either access the MHEC-created Verification of Tax Non-Filing form in their MDCAPS account or can request a Verification of Non-Filing letter from the IRS

The Guaranteed Access Grant maximum amount is calculated annually based on the approved State budget allocation.

The amount of the Guaranteed Access Grant equals up to 100% of a student’s calculated adjusted financial need for the student's first 2 academic years of enrollment, or up to the maximum award amount, whichever is lower.

Students who have been awarded have their grant amounts calculated based on the cost of attendance at the institution, the student’s living situation (on campus, off campus, or with parent), and the amount of financial need they have.

The maximum award amount for the 2026-2027 academic year will be determined in spring 2026. In 2025-2026, the maximum award amount was $18,000.

The minimum award amount a student can receive is $400 per year. If a student has a calculated financial need that is below this amount, or their need has been calculated as fully met, the student will not receive funding.

All Guaranteed Access Grant awarding is contingent on the availability of funds.

Renewal Requirements:

The Guaranteed Access Grant can be renewed for up to 3 years. For recipients to remain eligible for the GA, they must:

- Remain eligible for in-state tuition in Maryland;

- By March 1, 2026: file the 2026-2027 Free Application for Federal Student Aid (FAFSA) or State financial aid application for undocumented students (formerly MSFAA) through the new MHEC One-App;

- The FAFSA is open to U.S. Citizens and Eligible Non-Citizens

- The State financial aid application through the MHEC One-App is for residents of Maryland who are eligible for in-state tuition but NOT eligible to file the FAFSA (undocumented students)

- Students must have a Maryland university or college listed on their FAFSA or MHEC One-App by March 1, 2026

- Meet the renewal income requirements for the 2026-2027 academic year (see Renewal Income Requirements below);

- Enroll as a full-time, degree-seeking undergraduate student at an eligible two-year or four-year Maryland institution;

- Maintain the satisfactory academic progress standards of the enrolled institution;

- Have not received a bachelor’s degree prior to the start of the 2026-2027 academic year;

- Submit any required documentation by August 1, 2026 (see Documentation above);

- Students who have received the award for at least two years and thereafter must (See Credit Completion Requirements linked below for more information):

- Annually complete 30 credits in order to have their awards renewed for the full amount of their adjusted financial need or

- Annually complete 24-29 credits in order to have their awards renewed for a prorated amount of their adjusted financial need

2026-2027 GA Renewal Applicants – Income Requirements

Renewal recipients of the GA must have an annual total family income that is at or below 150% of the federal poverty guidelines for the prior-prior tax year (2024 tax year for the 2026-2027 academic year) OR remain eligible to receive a federal Pell Grant.

| Household Size | 150% of 2024 Federal Poverty Guidelines |

| 1 | $22,590

|

2

| $30,660 |

| 3 | $38,730 |

| 4 | $46,800

|

| 5 | $54,870

|

| 6 | $62.940

|

7

| $71,010

|

| 8 | $79,080

|

For each additional family member beyond eight, add | $8,070

|

Additional Information