How to Complete the Required Verification Forms for the GA Grant

Completing the Dependent/Independent Student Verification Worksheet

The Dependent Student Verification Worksheet and the Independent Student Verification Worksheet are documents that are requested for all initial applicants selected by MHEC for the verification process.

- A Dependent Student Verification Worksheet is sent to a student that resides with his or her parent(s) and is financially supported by the parent(s).

- An Independent Student Verification Worksheet is sent to a student that is not living with their parents or receiving any financial support.

How do I properly complete the Verification Worksheet?

Section A of the Verification Worksheet require demographic information for the student as well as the MHEC ID number which a student can find by viewing any notification sent to him/her from MHEC.

Common Mistakes- Students are unaware of his/her MHEC ID number and do not include it on the form.

A student can find his/her MHEC ID number listed on any correspondence sent to them from the Office of Student Financial Assistance (OSFA) at the Maryland Higher Education Commission (MHEC). As well as online through there MDCAPS account by printing out the “Cover Sheet” under there To List tab.

Section B of the Verification Worksheet will require the student’s information and information regarding the student’s household members.

If the student is a dependent student completing the Verification Worksheet, section B should include the student along with his/her parent (that provides at least 51% of support). All members of the household for whom the parents provide more than half (51%) of support for should also be listed in this section, along with their age, the relationship to the student, and the college/university that the member of the family is attending.

If the student is independent completing the Verification Worksheet, section B should include the student’s information along with his/her spouse’s info (if applicable). Information for any dependents of the student for him he/she is providing more than half (51%) of support, should also be provided in Section B.

*The first line in Section B should be the student’s information.

The first line of section B should include the student’s information. The other lines should include the applicable household members.

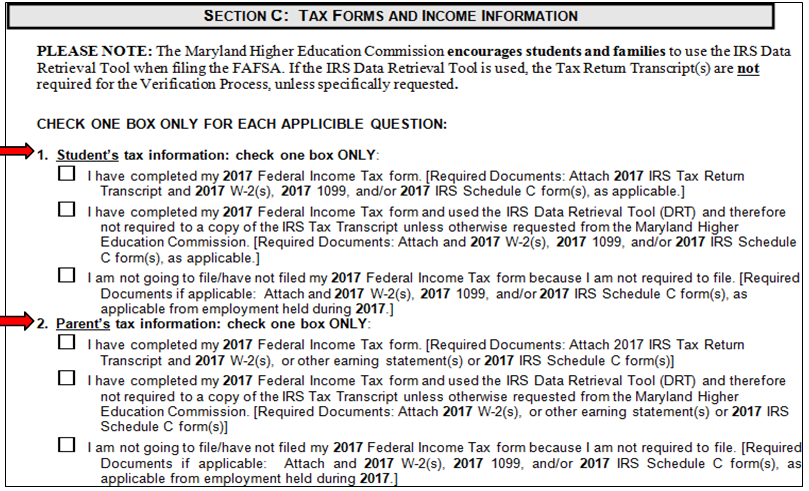

Section C Number 1 and 2 of the Verification Worksheet is designated for students to indicate if he/she has filed taxes for the 2017 tax year and to report if the IRS Data Retrieval Tool (DRT) was used when filing the FAFSA.

This information is required for both the student and the parent (if completing the Dependent Student Verification Worksheet) and the student (if completing the Independent Student Verification Worksheet).

Section C

Section C question 3 is applicable if a student, parent, or spouse did not file taxes in 2017, but had earnings. If the student, parent, or spouse did not file taxes and received income in 2017, the income is to be reported in this section. Once the income information has been reported, a W-2 or 1099 from the 2017 tax year should be provided to MHEC.

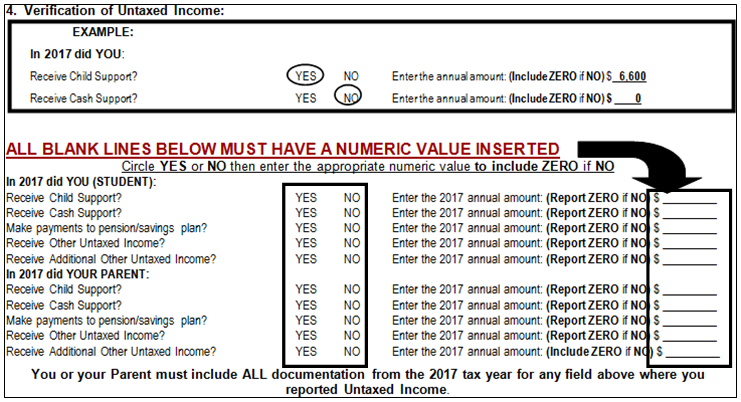

Section C question 4 of requires the student and or parent to include information regarding untaxable income that was earned in 2017; (if completing the Dependent Student Verification Worksheet), and spouse (if completing the Independent Student Verification Worksheet).

Common Mistakes

Common Mistakes- Students do not check the boxes for questions 1 and 2

- Students do not include information in section 3 for themselves, the parents and/or spouse who did not file taxes but had earnings in 2017

- Students do not provide amounts for the untaxed income that he/she has indicated has been received.

Students must check the applicable boxes for questions 1 and 2 as well as provide applicable information in section 3 for those persons that had earnings in 2017 but did not file taxes.

Also, all untaxed income received in 2017 should be indicated in question 4 of section C and supporting documentation should be provided.

IMPORTANT: Be sure that you enter a numeric value even if you have answered ‘no’ to the question. Blanks are not acceptable and will be noted as INCOMPLETE.

Section D is the last section of the Verification Worksheet. This section requires a signature of the student and the parent (if completing the Dependent Student Verification Worksheet), or student and spouse (if completing the Independent Student Verification Worksheet).

A friendly reminder that all information for consideration of the Guaranteed Access Grant program must be submitted to MHEC by April 1, 2019.